About the Framework

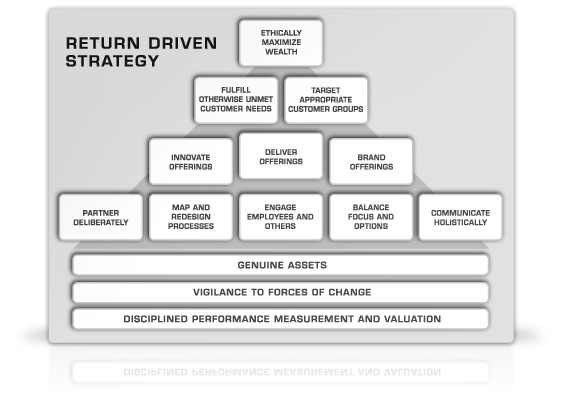

Return Driven Strategy™ is a framework that helps leaders to better analyze, understand, and employ the activities that have been shown to produce superior returns and wealth creation.

The Return Driven Strategy framework describes the pattern of strategic activities of high performance companies regardless of industry or geographic location. In our research of over 20,000 companies for 20 years or more of data, this meant a company showed superior performance for 10 consecutive years or more in three performance measures: ROI, Growth and Total Shareholder Returns. Cash Flow ROI was at least twice the corporate averages for; Growth rates in the investments management is made in the business exceeded average market growth rates and Total Shareholder Returns relative to the market reflected these ROIs and growth rate thereby outperforming the market for at least 10 years. About 100 currently publicly-traded Return-Driven companies met this criteria.

The framework is a summary of eleven tenets against a backdrop of a delta symbol, the symbol for change. These represent eleven important activities that lead to wealth creation. The first tenet, at the top of the pyramid, is a commitment to wealth creation itself. The other ten tenets sit below as the means for reaching that highest tenet. The base of the pyramid is made of three foundations. These foundations apply to every tenet in the pyramid.

Very different ideas about what makes a business successful

The following is a sample of the concepts explained in Driven. These often reveal misunderstandings about business strategy that have led many companies to destroy value, or have severely limited the wealth that could have been created.

• Businesses with great products are often not great businesses

• When to shrink and grow rich – or grow and be poor

• Why “first mover advantage” is often anything but

• The undeniable financial impact of business ethics on performance

• “Being different” is a by-product of great strategy, not a focus

• How a monopoly, generally so desired, will cause valuations to stagnate

• The difference between a great company and a great stock

• The real customer needs are seldom the obvious ones

• How treating employees as customers generates higher returns to all constituents

• Which is more important, strategy or execution? Both.

Some of these concepts can come as a surprise, but the underlying financial and practical support for them is substantial.

An outline of the Framework.

Of everything that Return Driven Strategy offers to its users, a primary benefit is better resource allocation: the prioritization of time and efforts in planning, analysis, and implementation.

As projects compete for capital, time, and resources, Return Driven Strategy can assist management in choosing and timing the actions that are best poised for achieving the organization’s goals.

Eleven Tenets and Three Foundations combine to form the Return Driven Strategy framework. These appear in pyramid form, in order of importance of priority in long-term performance and valuation impact.

The following is a summary of the framework.

TENET ONE

Ethically Maximize Wealth

In order to achieve wealth, management must first define it explicitly. The firm should then align all of its activities toward that goal of wealth-creation as defined. Top-performing managers are very clear about what they are trying to achieve and how they intend to get there.

In order to create wealth, one must first not destroy it. A mountain of financial evidence shows that gross unethical conduct is a business risk that does not bear a justifying reward. The definition and pursuit of wealth must fall within the ethical parameters of the communities in which the business operates. Failure to operate ethically risks everything that the managers have and hope to achieve. An incredibly extensive history of business valuations proves this concept clearly.

TENETS TWO AND THREE

Fulfill Otherwise Unmet Customer Needs

Target Appropriate Customer Groups

The path to high-performance and wealth-creation is through the customer – by fulfilling the unmet needs of lots of customers, in ways no one else can.

Customer satisfaction or quality ratings do not necessarily translate into superior financial performance. Unfortunately, the world is littered with businesses with mediocre performance despite those businesses providing the best products. Real pricing power stems from providing offerings that are greatly needed and yet have no substitute. Pricing power leads to higher returns.

The term ‘quality’ means very different things to different people. A person chooses one product or service over another because of a set of attributes that reside in the mind of the customer, which may be totally different from what would appear obvious at first. High-performance firms reap the benefits of understanding the psychological reasons behind customer purchases.

Return-driven businesses target customer groups that support the wealth-creation goals as they have been defined. If investors define wealth as a stable net income stream, then the firm needs to target stable customer groups with consistent needs. High investment growth opportunities may require targeting high growth customer groups, but where returns can be far more volatile and uncertain. Stability in income and maximum increases in income are generally not achievable at the same time.

Achievement of high returns hinges on being the dominant provider of offerings to the appropriate customer group.

TENETS FOUR, FIVE, AND SIX

Deliver Offerings

Innovate Offerings

Brand Offerings

Three core competencies form the driving force behind the creation of the right offerings for the right customers. No single competency is sufficient. These must be balanced as the customer groups and customer needs would require. A business should not ‘choose’ a particular competency, but continually adjust its competencies as the higher tenets would direct.

Deliver Offerings: High-performance firms deliver offerings to customers as planned, promised, and expected. This does not mean perfect execution every time. It means understanding the expectations that customers have for fulfilling a particular need, and meeting those delivery requirements.

In some industries such as retail, customers may be satisfied with goods being mispriced one in a hundred times, so long as the lowest possible price is received overall. In other industries, such as vehicle braking systems, one fault in a million is one too many.

Innovate Offerings: Customers’ unmet needs change over time as do the methods available for fulfilling them. When customer needs change rapidly, business offerings can quickly become obsolete. Rapid innovation is necessary to change with them. Innovation of offerings is the solution to protecting existing markets and expanding into new ones.

Brand Offerings: Branding is an important competency when brands act as bridges. Successful firms create a bridge between the customers’ knowledge of the offering and their explicit awareness of their unmet need. Done in an emotionally compelling way, purchases can be induced at pricing levels that reflect the business’s efforts.

Together, these three competencies are necessary for driving high returns at any firm and in any industry. The right balance of the three is dependent on the higher tenets.

TENETS SEVEN THROUGH ELEVEN

Partner Deliberately

Map and Redesign Processes

Engage Employees and Others

Balance Focus and Options

Communicate Holistically

High-performance firms display five specific types of activities for enhancing their ability to achieve the higher tenets. While the same activities appear in lower-performing firms, the difference lies in the degree of alignment of these activities with the higher tenets.

For example, lower-performing firms engage in partnering and other activities indiscriminately, taking up valuable resources that result in limited benefit to any of the firm’s constituents. However, when each of these tenets is used for the specific purpose of better accomplishing the competency tenets, higher performance results.

THREE FOUNDATIONS OF BUSINESS STRATEGY

The three foundations form the base of the pyramid. They apply to each tenet. Achievement of each tenet requires consideration of the three foundations.

1.Genuine Assets

The Eleven Tenets are the verbs of a successful business. Genuine Assets are the nouns that create competitive advantages and sustainability of high performance. Genuine Assets are unique tangible or intangible assets that are difficult or impossible to copy. Examples include unique patent portfolios, exclusive customer relationships, proprietary customer information, and key geographic locations.

When businesses create and deploy Genuine Assets in their activities, they greatly increase the potential to create unassailable advantages. A business should engage in a particular activity using a Genuine Asset, such that without that Genuine Asset, the activity cannot be copied.

For example, a Genuine Asset, such as a monopoly on vending machines, could create situations where other businesses cannot target the customers at those locations. Or, a Genuine Asset may be an exclusive partnership and right to distribute a particular product, such that no other distributor can sell that product. A set of patents is an example of a Genuine Asset that makes it difficult or impossible to recreate a particular offering for some fixed amount of time. Genuine Assets are the building blocks of sustainable competitive advantage throughout the entire pyramid of tenets.

2. Vigilance to Forces of Change

Dynamic threats and opportunities arise for businesses regularly. The adage is that change is a constant. To succeed, business activities need to be continually reevaluated. Three distinct areas where forces of change arise require close watching. These three areas are the following:

• Governmental and regulatory change

• Demographic and cultural shifts

• Scientific and technological breakthroughs

Formerly great businesses have been decimated by forces of change that can be described within the context of these three categories. Meanwhile, many businesses have launched and made trillions of dollars by capitalizing on the same forces. Vigilance of change is necessary, adjusting the pursuit of each tenet accordingly.

3. Disciplined Performance Measurement and Valuation

This foundation is the underlying bedrock of all great business planning, analysis, and performance. Business flaws can frequently be tied to misunderstandings of how business plans, implementation, results, and valuation are quantitatively linked. An inability to understand what drives valuations, particularly in the stock market, will cause managers to do the wrong things.

Performance Measurement: The complexity of financial statements of even simple businesses can make it difficult for users of those financials to understand the economic reality of a company’s performance. Even simply knowing whether or not a business’s performance is directionally good or bad can be difficult to discern from the financials.

A few statements can summarize the recognition of the importance of performance measurement at firms. These include, “If you can’t measure it, you can’t manage it,” “What gets measured gets done,” “People do what they are paid to do,” and “It’s better to be approximately right than precisely wrong.” Measuring the right things at the right times is an important aspect of building a business planning framework such as Return Driven Strategy.

Strategic Valuation: While performance measures gauge what has happened historically or what is happening now, valuation is about forecasting the performance of the future. This brings about an entirely new set of issues. Concepts arise like business life cycles and the opportunity cost of capital employed. These are necessary to understanding the value of a firm.

Foremost of the misconceptions in business analysis and valuation is the too-common belief that companies that see dramatic increases in stock price are necessarily great companies. This simply isn’t the case. Great companies often have average stock performance. Relatively poorer performers will often have great stock price appreciation, even over several years.

With this knowledge, one can recognize “The difference between a great company and a great stock,” and the problems that arise when managers confuse one for the other.

DIFFERENT ANALYSIS, DIFFERENT CONCLUSIONS

The financial discipline underlying this business strategy research is not inconsequential. Many firms that receive substantial press for being highly admired companies are found to have admirable public relations skills, but less than respectable financial performance.

At times, companies regarded as “great” have in actuality been great turnarounds. Firms like this are worthy of study for how to dig a business out of a hole, but are greatly lacking as cases for high value achievement.

Many businesses don’t receive a lot of press, yet quietly generate cash flow returns that amaze investors. They produce offerings built by engaged employees and partners that are subsequently purchased by customers who voluntarily pay high prices to fulfill their needs in ways they could not otherwise.

People can make better decisions when they understand the connection between business planning, business actions, and wealth-creation. As authors and practitioners, we hope to provide an easy-to-understand, straightforward approach to business planning and evaluation. We respectfully offer Return Driven Strategy.

|